Ideal Energy Supply Strategy For 2023

This month’s column will continue to focus on the impact of high energy rates because of supply constraints and the conflict in eastern Europe. The target audience are consumers that have third party agreements coming to term at the end of 2022 and those that have accounts with the utility’s default. Our high-level message is to develop a plan that includes a benchmark. It is a given that energy costs will be higher over the next several years. A cost containment approach is to set trigger rates.

The Henry Hub natural gas market was up 20% in April ($5.79/Dth to $7.24) and up 187% in 2022. Multiple factors are causing the unprecedented rise. It started when Producers kept supplies flat during the pandemic followed by the increase in demand following the easing of locked downs. The geopolitical event in eastern Europe is the current culprit that has pushed multiple commodities higher with the increased risk of a world war and retaliation by Russia to cut gas supplies into western Europe. Although we are seeing an elevated market in the US, the market price for gas in Europe is at $40/Dth. Electric rates in London and Paris average almost $0.50/kWh.

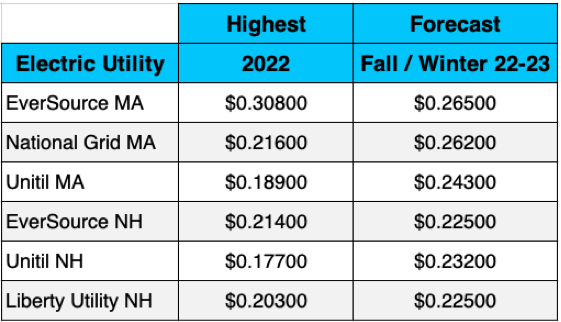

Further analysis of electric default rates this past winter in New England shows that the supply rates from utilities were the highest since records were published in 2005. Please note that the highest rates were for the month of February. The forecast below, based on today’s market, covers the average November through May winter season with any single month that can exceed the average.

The message is to budget a 50% increase for the energy line item over the next three years and to hedge the energy costs whenever possible. Please see the recommendations for suggestions.

The ‘elephant in the room’ is the conflict in eastern Europe. It is my belief that a resolution will be the ceiling with energy prices. The links below provide possible scenarios on how and when the conflict will end. A recent report from Ukrainian Intelligence shares that Russia intends to end the invasion in September. If true, the call for action will be to enroll in September and October with an expectation that the markets will come off from their highs.

https://www.msn.com/en-us/news/world/russias-invasion-of-ukraine-4-ways-this-war-could-end

https://www.msn.com/en-us/news/world/ukraine-intelligence-says-russias-war-may-end-in-september

RECOMMENDATIONS

•Electric consumers who are supplied by the utility should enroll with either short-term fixed rates until late this fall or a long term beyond 2023. In addition, consumers that have third-party agreements coming to term this fall should enroll with a term that incorporates lower rates in 2024/2025 because of the lower ‘sweet spots’. This should be accompanied with a trigger rate for enrollment.

•A hedging option to build an average rate over the next six months by grouping the electric and natural gas accounts into three buckets and enroll with third-party supply every two months. This is like financial hedging a portfolio.

•The ‘wait & see’ approach until the fall with a possibility that the market may come off may work. But, it may continue to appreciate. That will result in higher medium to longer-term costs. The longer-term third-party agreements will give budget certainty at the trigger rate with a possibility to lower the ceiling through a ‘blend and extend’ if the market drops.

•We have advocated for natural gas consumers to enroll with third party supply in November as to take advantage of lower summer rates from the utility and budget certainty during the winter. We now believe that enrollment with third party this spring is an acceptable approach that will contain costs in the back end. We suggest enrolling with a minimum term of 24 months because anything less is expensive.

The Neighborhood Energy team is versed to explain the ‘what if’ scenarios along with strategic counsel that will help you focus on your core competencies while keeping energy costs contained in a volatile environment.

Thank you for your continued support, your friendly Neighborhood Energy